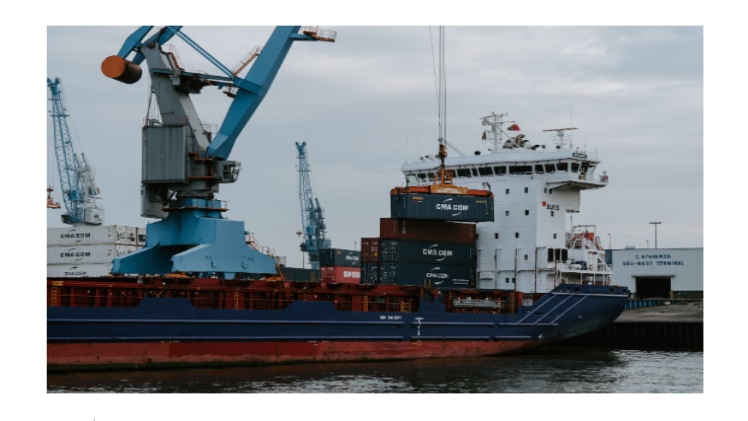

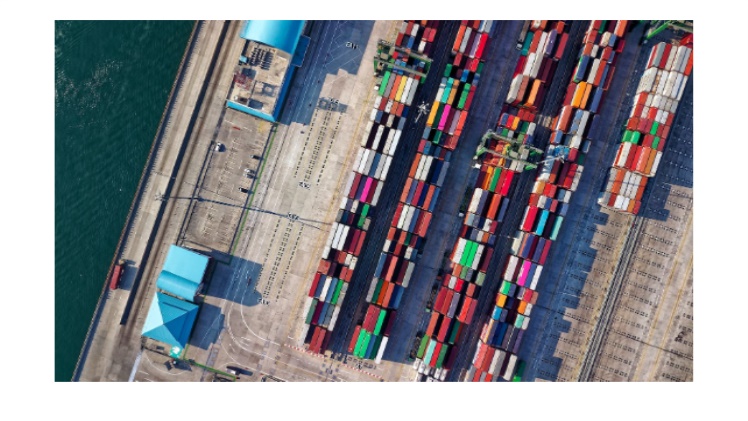

Cargo policy insurance is a vital safety net for businesses involved in transporting goods across land, air, or sea. This form of insurance protects against losses and damages that can occur during transit, including theft, physical damage, and liability for third-party losses like property damage or bodily harm. It’s an invaluable asset for businesses that regularly ship goods, ensuring their investments remain secure in the face of unpredictable challenges.

Understanding Cargo Policy Insurance

Cargo policy insurance is a specialised type of coverage designed to protect goods and merchandise during their journey from origin to destination. Its purpose is to shield businesses from financial losses caused by damage, theft, or delayed delivery of their cargo. This coverage applies to various modes of transportation, including maritime, aerial, and land-based, offering global protection. One remarkable aspect of cargo insurance Sweden is flexibility. Policies can be customised to suit the unique needs of each business. Coverage extends beyond transportation and includes protection at different points along the journey. It safeguards against a wide range of potential risks, such as conflicts, theft, labour disputes, and natural disasters.

The extent of coverage depends on factors like the type of policy and chosen deductibles. Typically, these policies protect up to 110% of the replacement value for lost items, with an additional 10% allocated for legal fees associated with claims.

Exploring Cargo Policy Options

Cargo policy insurance caters to diverse business needs with several common types of coverage:

All Risk: These policies provide comprehensive coverage for damage, loss, and theft, except for explicitly excluded perils like war or nuclear radiation. They safeguard against a broad spectrum of external threats.

Warehousing Liability: This coverage protects against liability claims related to goods stored in warehouse facilities, including property damage and bodily injury. It also covers legal fees for defending against such claims.

Haulers Legal Liability: This policy extends coverage to damages resulting from vehicular accidents during goods transportation via trucks or other vehicles.

Benefits of Cargo Policy Insurance

Businesses gain numerous advantages by embracing cargo policy insurance:

Financial Security: Cargo policy insurance offers financial protection by covering losses from damaged or stolen goods during transit. It includes costs for lost or damaged items and additional expenses due to delays, making it crucial for valuable items that need timely and secure delivery.

Coverage Flexibility: Businesses can tailor cargo policy insurance to match their specific needs and budgets. It considers factors like the type of shipping and varying levels of risk. Options range from per-package limits to all-risk policies, providing protection against all possible shipping-related losses.

Stress Reduction: Delegating freight shipping responsibilities to experienced professionals reduces the complexities associated with logistics. This allows businesses to focus on core activities while ensuring peace of mind regarding transportation management.

Choosing a Cargo Policy Provider

Selecting the right cargo policy provider is essential for business success. Consider factors like:

Financial Stability: Assess the financial stability of potential providers by checking ratings from industry organisations. A reliable company can meet its obligations promptly in case of accidents or theft during transit.

Coverage Options: Understand the coverage options offered by providers and ensure they align with your business’s specific needs.

Coverage for Different Types of Goods

Different types of goods require tailored coverage options. Marine cargo insurance is a top choice for physical goods, covering shipping-related risks such as theft, damage, or delays. It also includes liability protection for third-party losses during transit. Traders also have options like exchange-traded futures contracts and commodity insurance to protect against price fluctuations.

Common Exclusions in Cargo Policy Insurance

While cargo insurance offers robust protection, it’s crucial to be aware of common exclusions, including losses due to war, packaging errors, illegal activities, special items, storage damage, and incomplete documentation.

Cost and Availability of Cargo Policy Insurance

The cost of cargo policy insurance depends on factors like the type of goods, destination, distance, and additional endorsements. Availability is widespread, with major insurers offering options to meet various needs.

Conclusion: Safeguard Your Cargo

In conclusion, cargo policy insurance is an indispensable shield for businesses involved in transporting goods. It provides comprehensive protection against a range of risks, ensuring that valuable cargo reaches its destination safely and securely. By understanding the diverse policy options and choosing the right provider, businesses can navigate the complex world of logistics with confidence.