As the world becomes more digital, the way we manage our finances is evolving. Sending money abroad can be a hassle, especially when you consider traditional methods of sending money like bank drafts or money orders. Fortunately, with the rise of money transfer apps, you can now send money to anyone with just a few clicks. In Malaysia, mobile apps have become increasingly popular for sending money, with many people turning to online bank transfer and apps like Lotus Remit for their financial transactions.

Accessibility

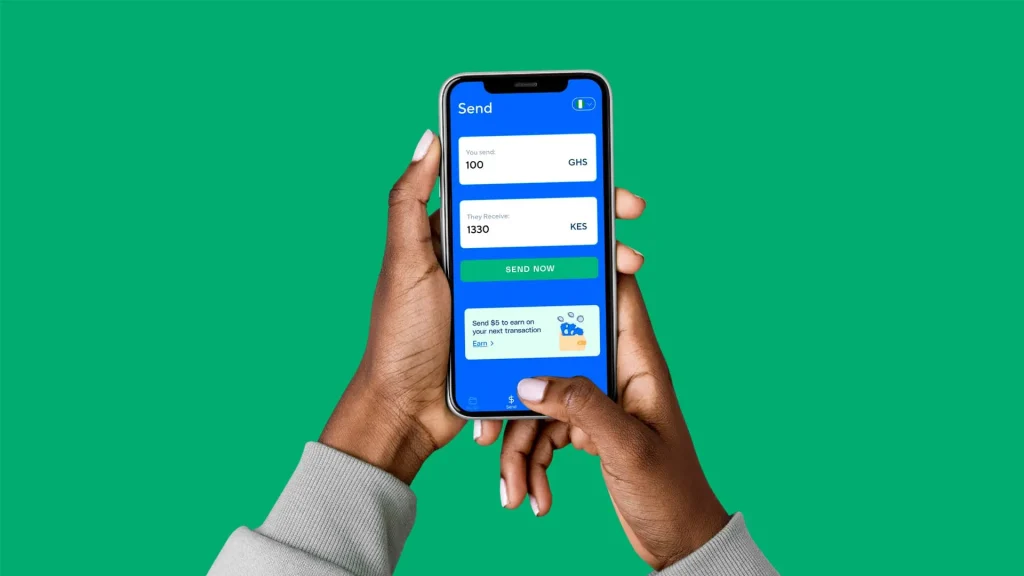

One of the key benefits of using a money transfer app is accessibility. Unlike traditional methods of sending money, where you would need to physically visit a bank or money transfer services, a money transfer app allows you to send money from anywhere at any time. All you need is a smart phone and an internet connection. This makes sending money much easier and more convenient, especially if you live in a rural area, or if you have a busy schedule.

With a money transfer app, you can send money instantly, without having to wait for the money to clear. This is particularly useful for emergency situations, where you need to send money quickly to someone in need.

Convenience

Another major advantage of using a money transfer app is convenience. With a money transfer app, you can send money without having to fill out long forms or provide extensive documentation. All you need is the recipient’s name and phone number or bank account number, and you’re good to go. This saves you time and effort, and makes the process of sending money much more streamlined.

In addition, many money transfer apps offer additional features that make the process of international money transfer even more convenient. For example, with Lotus Remit, you can set up recurring transfers, so you don’t have to worry about manually sending money every time. You can also save your recipient’s details, so you don’t have to enter them every time you send money.

Lower Fees

Sending money using traditional methods can be expensive, with high transaction fees and exchange rates. Money transfer apps, on the other hand, often offer lower fees and more competitive exchange rates. This can save you money in the long run, especially if you frequently send money overseas.

With a money transfer app like Lotus Remit, you can send money at a competitive exchange rate, with low transaction fees. This means you get more value for your money, and your recipient receives more money on their end.

Secure Transactions

When it comes to sending money, security is paramount. Money transfer apps offer secure transactions, with many using advanced encryption technology to protect your personal and financial information. This ensures that your money is safe and that your personal information is protected from fraudsters and hackers.

In addition, apps offer extra security features such as two-factor authentication, biometric login, and PIN protection. This gives you added peace of mind, knowing that your money and personal information are safe and secure.

In conclusion, money transfer apps offer many benefits for send money to India from Malaysia. They are accessible, convenient, and offer lower fees and more competitive exchange rates than traditional methods of sending money. They offer secure transactions, protecting your personal and financial information from fraudsters and hackers. If you frequently send money overseas, using a money transfer app like Lotus Remit can save you time, effort, and money, while also providing added security and peace of mind.